Asset portfolios

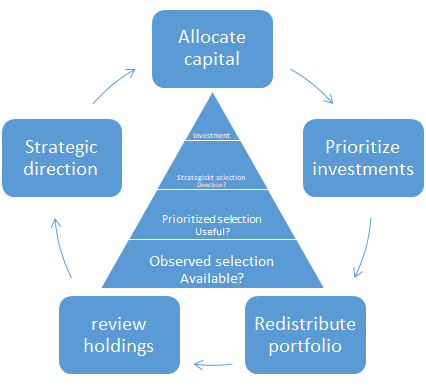

An advantage with structuring holdings into a portfolio is the ability to distribute ownership over several holdings in various stages and areas, and as such reduce risk exposure. An active acquisition and liquidation strategy to improve the composition of strategically weighted portfolio holdings that meet market needs over time helps optimizing the return on investment.

The primary objective of active portfolio management is to outperform the return of its underlying benchmark.

Here, a holding company also creates the conditions for growth by allowing the holding company’s sales profit pre tax (Sweden) to be used for new investments or profit distribution.

Holding company

A limited company whose main purpose is to own shares or shares in one or more other companies is called a holding company or management company. Holding companies rarely carry out their own operational activities. When holding companies own the majority of the shares in a company, the owning company is usually referred to as a parent company. The companies in which you own shares are then called subsidiaries and together they are part of a group. Holding companies exist among all types of businesses, both large and small, and in all industries. In the case of minority ownership, the companies in which you own shares are called portfolio companies.

A holding company can provide tax advantages (Sweden), for example when selling companies owned by the holding company. When companies are owned by holding companies, on the other hand, the sales profit pre tax ends up with the holding company and can be used there to, for example, start new companies or be distributed as dividends to the shareholders. Earned profits from subsidiaries can also be distributed to holding companies. This way the risk that can be involved in keeping a large amount of capital in an operating company is eliminated. With a holding company, there is also the possibility, under certain conditions, to lend money, give group contributions and equalize results between companies in the same group, which can be tax-advantageous.